The latest summary edition of our monthly Australian energy & environmental market update is now available. Keep reading for energy and carbon pricing movements, policy updates and other news.

This month we cover energy and environmental market movements, the Australasian Emissions Reduction Summit, the 2023 Update of the IEA Net Zero Roadmap, and the amendment to the National Electricity (South Australia) Act.

Keep reading for an overview of key market developments and a discussion of the impact of these announcements.

The full version of the update, with additional commentary from our industry analysts, is available to paid subscribers. Contact our team to find out more.

The International Energy Agency (IEA) has updated their original 2021 report, the update reflects new developments and highlights the rapid scaling of the industry with the potential to meet the 2030 demand.

The 2023 update to the Net Zero Roadmap surveys this complex and dynamic landscape and sets out an updated pathway to net zero by 2050, taking account of the key developments that have occurred since 2021.

August 2023 marked an unprecedented record as the hottest month ever, surpassing even July 2023 by a significant margin. The consequences of climate change are growing in frequency and intensity, while the scientific community's warnings about the perils of our current trajectory have grown stronger than ever before.

Global carbon dioxide (CO2) emissions originating from the energy sector reached an all-time high in 2022, totaling 37 billion tonnes (Gt), which is 1% higher than pre-pandemic levels. However, there is optimism that these emissions will peak within this decade. The rapid expansion of essential clean energy technologies has led the IEA to project that the demand for coal, oil, and natural gas will reach its zenith in the coming years, even in the absence of new climate policies. While this is a positive trend, it falls short of the 1.5 °C target.

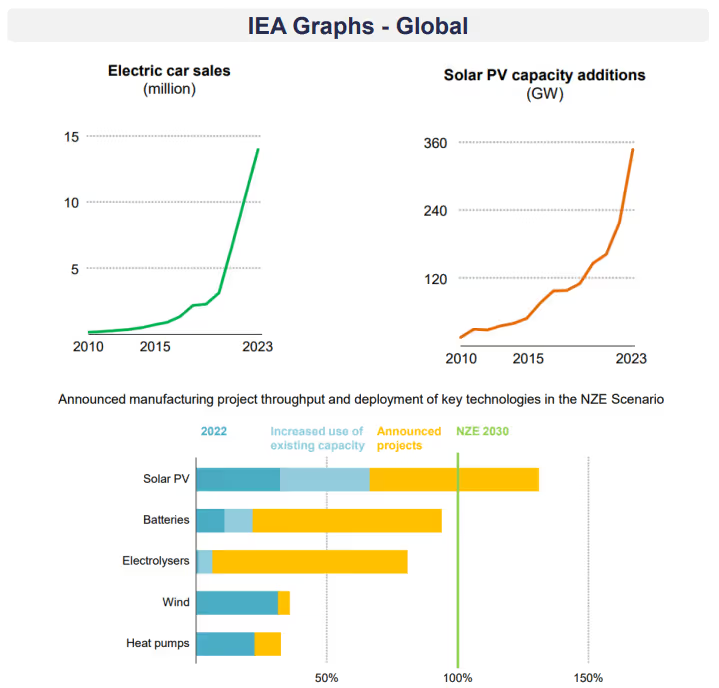

In the last two years, there have been encouraging developments, including the installation of solar PV systems and the sales of electric cars, both tracking in accordance with the milestones outlined in our 2021 report on achieving Net Zero by 2050. In response to the pandemic and the global energy crisis triggered by Russia's invasion of Ukraine, governments worldwide have introduced a range of measures to encourage the adoption of various clean energy technologies. The industry is rapidly scaling up to meet the demand for these technologies.

If these announced expansions in manufacturing capacity for solar PV panels and batteries are fully realized, they have the potential to meet the demand by 2030, as outlined in this updated version of the Net Zero by 2050 Scenario.

With the passing of the Emission Reduction Objectives Bill 2023, the AEMC can now consider the environmental factors alongside other price, quality and reliability frameworks when rule-making and reviewing processes.

The Australian Energy Market Commission has announced its commitment to incorporate emissions reduction objectives into its rule-making and review processes. This marks a crucial reform in the Australian energy market, described as the most significant in decades.

This development comes after the passage of the Emissions Reduction Objectives Bill 2023 through the South Australian parliament, with official gazetting of assent. As a result, the AEMC can now factor environmental considerations alongside the established criteria of price, quality, safety, reliability, and security.

This announcement signifies the first substantial amendment to the National Energy Laws' objectives in 15 years and is anticipated to trigger a re-evaluation of critical rules and regulations. These revisions will play a pivotal role in expediting the transition from coal and gas to a renewable energy-driven grid.

Perhaps most notably, it is poised to streamline Australia's ambitious "Rewiring the Nation" initiative by facilitating investments in essential grid upgrades needed to support the transition to renewables and energy storage.

AEMC Chair Anna Collyer remarked, "This change presents a significant opportunity for us to formally consider emissions reduction in our work, helping to manage the transformation towards a net-zero future, as we continue to safeguard the long-term interests of consumers."

The Australasian Emissions Reduction Summit hosted in Sydney by the Carbon Market Institute (CMI), highlighted market trends and the barriers still faced by the industry.

The Australasian Emissions Reduction Summit organized by the Carbon Market Institute (CMI) reached its conclusion on Friday the 15th of September, instilling a fresh and heightened sense of urgency for expediting both public and private investment in the industry. It also emphasized the importance of seizing opportunities within a rapid, equitable, and sustainable transition.

This milestone event, celebrating its 10th year, attracted more than 1,000 participants both in-person and online. It convened a diverse assembly of attendees, including national and state-level politicians and officials, global experts in climate policy, developers of carbon farming projects, delegates from heavy industries, investors, and representatives from environmental advocacy groups. CORE Markets was once again a Diamond Sponsor of the event.

Key points made:

"We need to be prepared to make mistakes. The biggest risk is missing the opportunity to limit the damage of climate change. And at our current speed of change, the change will come too late. Perfection is the enemy of the good, perfection is the enemy of the planet." – Chris Halliwell, CEO and co-founder of CORE Markets.

“It’s been a tumultuous yet transformative last 10 years, and the next decade promises to be even more intense, but hopefully less of a rollercoaster and much more productive.” – CMI CEO, John Connor.

“We need to go faster… We are just going to have to get it done, and it’s going to be quite messy, and it is probably going to be expensive… we have missed the boat in terms of being able to talk about doing this at least cost.” – Alison Reeves, Grattan Institute Deputy Program Director.

“Noting the poor progress recently highlighted in the just released Global Stock take report, [COP28] will be a critical opportunity to course-correct and build climate stability and resilience.” – UNFCC Executive Secretary, Simon Steill.

Log in or register a free CORE Markets account to get closer to power, environmental and carbon markets with insights and updates from our experts.

Australian energy markets: The policy developments in South Australia set a precedent for other states as they move to harmonise the NEM. The changes are likely to lead to more considered investments into the grid, keeping both the environment and consumer needs in mind while supporting the renewable energy transition.

The evolving policy framework is another key consideration for organisations when developing their energy sourcing strategy for this period of transition. Forward-looking organisations are taking the time to define this strategy based on business-specific decarbonisation goals and internal risk profile, with many taking the long-term view out to 2035.

Australian carbon market: While the Generic ACCU Spot price fell slightly in September, the market was much less volatile than in previous months. In a consistent trend, method specific ACCUs continued to trade at various premiums to the generic price.

The CORE Markets advisory and transactions teams are seeing a growth in interest in the ACCU market, mainly from Safeguard Mechanism participants. The growth in interest was also apparent at the Australasian Emissions Reduction Summit, with visitors to the CORE Markets stand eager to learn more about the risks and opportunities facing Australian carbon market participants.

Forward-looking organisations, particularly from hard-abate sectors, are encouraged to develop their carbon procurement strategy early, even while their emissions reduction efforts are still underway. Doing so will assist in minimising potential financial and quality supply risk.

The events outlined in this months update highlight the evolving nature of carbon and energy markets and the complexity of the net zero transition.

To discuss your unique requirements, get in touch with our team today for a no obligation discussion on how we can help.

Australian Energy & Environmental Market Update for September 2023

Quarter 4 of 2025 marked another important period of adjustment for Australia’s ACCU market. While near‑term activity continued to be shaped by compliance cycles and existing supply, longer‑term signals around demand growth, supply development and price formation are becoming clearer.

Quarter 4 of 2025 marked another important period of adjustment for Australia’s ACCU market. While near‑term activity continued to be shaped by compliance cycles and existing supply, longer‑term signals around demand growth, supply development and price formation are becoming clearer.

Structural shifts in how energy is valued across the day are reshaping renewable project configuration and offtake strategy. For developers, buyers and investors, understanding the growing role of hybrid assets is becoming increasingly important to navigating today’s offtake market.